Elizabeth Warren and Bernie Sanders have long promised to cancel (some large portion of) student loan debt, if given more power. Biden recently announced his intention to cancel $10-20k of student loan debt (https://abcnews.go.com/Politics/president-biden-announces-student-loan-forgiveness/story?id=88736949). Other Democrats have called for Biden to cancel all student debt (https://www.usnews.com/opinion/should-student-loan-debt-be-forgiven). I’m not sure if they really think this is a good policy, or if they’re just trying to buy college-student votes. But it seems completely baseless to me.

1. Redistribution

Let’s be clear to start with: this is a wealth redistribution plan. Canceling $10,000 of someone’s debts is equivalent to giving that person $10,000, which must come at the expense of someone else. “Cancel student loan debt” means “make other citizens pay the debts of the former students”.

Is that a good idea? This may not be obvious to you; many people, after all, support many wealth redistribution policies. But no one supports all redistribution programs, right? If I said, “Hey, let’s give $10,000 to every left-handed person”, you wouldn’t support that, would you?

So let’s think about the reasons someone would support a redistributive program.

2. Reasons for Redistributing

a. Externalities

Maybe we should redistribute wealth to address externalities: if you’re harming other people in a way that you haven’t compensated for, maybe the government should take money from you. And if you’re producing benefits that you haven’t been rewarded for, maybe the government should give extra money to you. So, maybe the ex-students with debt are creating large positive externalities for society?

Well, there’s no reason to think that. The productivity benefits of education are mostly captured by the students themselves. They get better jobs after graduating, which means they are more productive – but they get paid for that. That’s why people get higher earnings after graduating. And there’s no reason to think they’re being undercompensated, compared to non-college-graduates. So there’s no more reason to give them extra money than to give extra money to any random person who is doing their job. (By the way, they’ve already gotten a big benefit, since they got lower interest and otherwise more favorable loan terms than they could have gotten in the free market.)

You might say education produces the benefit of a more informed electorate, and perhaps that produces better policy. Perhaps … but is there any evidence of that? Maybe college graduates are likely to be more left-wing due to the lessons from their left-wing professors, and that’s the benefit? But the idea of having the government pay to support a particular controversial political ideology seems pretty corrupt.

Or maybe college students just have more objective, factual information, which helps them select better positions, whether left- or right-leaning? Well, we can’t go into a long discussion on that, but I’ll just say that I’m extremely skeptical of the ability and willingness of professors to provide objective information about politics, as opposed to rank propaganda. To the extent that people get political information from college, it’s mostly false or radically misleading, and more of a negative externality to society.

Anyway, it would be pretty strange to hold that it’s specifically the ex-students who haven’t paid their debt who are producing the positive externalities. They’re the only ones who will get the payoff from “loan forgiveness”. If anything, the people who have paid their debts are more likely to be producing greater benefits for society.

b. Alleviating Poverty

Another main reason people support wealth redistribution is to help the poor. Poor people need money more than rich people do and can use it to satisfy important needs that may otherwise go unsatisfied.

But the people with student loans are generally not poor people. They’re typically middle class people. Most of the poor don’t go to college, whether or not they can get loans for it.

c. Supporting Education

Maybe we just want to support higher education in general. The “loan forgiveness” is just a way of subsidizing higher education.

But why would we give this subsidy specifically to the people who haven’t paid their debts, while giving nothing to the people who have paid their debt or the ones who worked their way through college to avoid taking on debt? If we just wanted to subsidize higher ed, we’d just pay everyone a certain amount to go to college.

Not that that’s a good idea, of course. It’s a total waste of money (https://www.amazon.com/dp/0691196451/). But at least it makes more sense than paying people just for having not paid back their loans.

d. Stimulus

Some people say that student loan forgiveness would be a huge “stimulus” to the economy (https://www.wealthauthnews.com/articles/what-would-actually-happen-if-all-student-loan-debt-was-canceled/). This is part of the general theory (seemingly universally accepted by politicians) that any time you use up resources, you get richer. Can you just claim that any redistribution “stimulates the economy”? Could I steal $50 from my next-door neighbor and then say that I’m stimulating the economy? Or is the author of the above article just forgetting that when the government gives one person money, they take it from someone else?

e. Buying Votes

Maybe Democrats think this move is going to help them win in 2024. I think it’s more likely to do the opposite: to help put Trump back in the White House. The policy is only appealing to people who were already on the Democrats’ side, and it doesn’t seem like the sort of thing that would cause people to suddenly go out and vote if they weren’t already going to.

Admittedly, this move is only one very small part of the Democrats’ overall losing strategy: the strategy of pandering solely to the most extreme voices in their own party, ignoring the majority of moderates and independents. They won in 2020 by nominating a perceived moderate. Since then, they’ve been working night and day to convince everyone that any Democratic politician who wins will be completely controlled by the party’s extremists.

The only reason the Democrats might still win is that the other side is going to follow the same “strategy” of pandering to their extremists. (Of course the Dems are going to lose seats in the mid-terms.)

* * *

In sum, I can’t think of any reason why someone would think this is a good policy.

3. Problems

a. Fairness to Taxpayers

Some people have been nonsensically comparing loan forgiveness to the trolley problem (wherein you divert a runaway trolley away from five people whom it was going to hit and toward only one person). But the standard trolley problem is completely unlike loan forgiveness, since loan forgiveness does not reduce the total cost of education. It merely shifts the cost — away from the people who agreed to take on the loans and directly benefitted from them, and toward people (taxpayers) who did not.

So a better comparison would be a Trolley problem wherein you divert a trolley away from five people who had voluntarily lain down on the track, knowing a trolley would hit them, and toward a different five people who didn’t do that. I can’t see how someone could think that was fair.

b. Making Suckers of Other Students

I went through college and graduate school, and I never took a loan. Instead, I worked. (In fairness, college was a lot cheaper then, so this was more feasible at the time.) Some other people take loans but then scrape and save over a period of years to pay off those loans.

It now turns out that all those people were suckers. If they’d taken on loads of debt then failed to pay it back, they’d have gotten a huge payoff from the government.

Imagine you just spent several years living in a tiny apartment in a run-down neighborhood, put off having a family, worked extra shifts, gave up unnecessary expenses, all to pay off your debts. When you finally pay it all off, the government announces that they’re going to give $20k to everyone who didn’t make those sacrifices and didn’t pay off their debt. As a taxpayer, you’ll be helping to pay those people’s debts. How would you feel at that point?

Here, a father who just got done paying for his kid’s college asked Warren about this:

. He mentions that he had a buddy who didn’t save money and instead bought a fancy car and took fancy vacations. After explaining the sacrifices he made to pay for his daughter’s college, he asks if he’s going to get his money back. She immediately says “Of course not,” as if that was the most ridiculous idea. Why of course not? Why is it obvious that you’d only give money to the people who took on debt and didn’t repay it?

My hypothesis is that Warren has never tried to put herself in the shoes of someone like that father; she is unable to empathize with people who work hard and make major sacrifices to ensure that they pay their debts. She can only identify with people who get in financial trouble and want help from the government.

c. Moral Hazard

Besides the fairness issue, this sort of thing sets up a moral hazard problem. After the Biden plan is implemented, many people taking on new debts will decide not to pay them back, in the hopes that another left-wing politician will get elected and pay their debts for them. They wouldn’t want to be suckers like those earlier people who missed out.

d. The Costs of Schooling

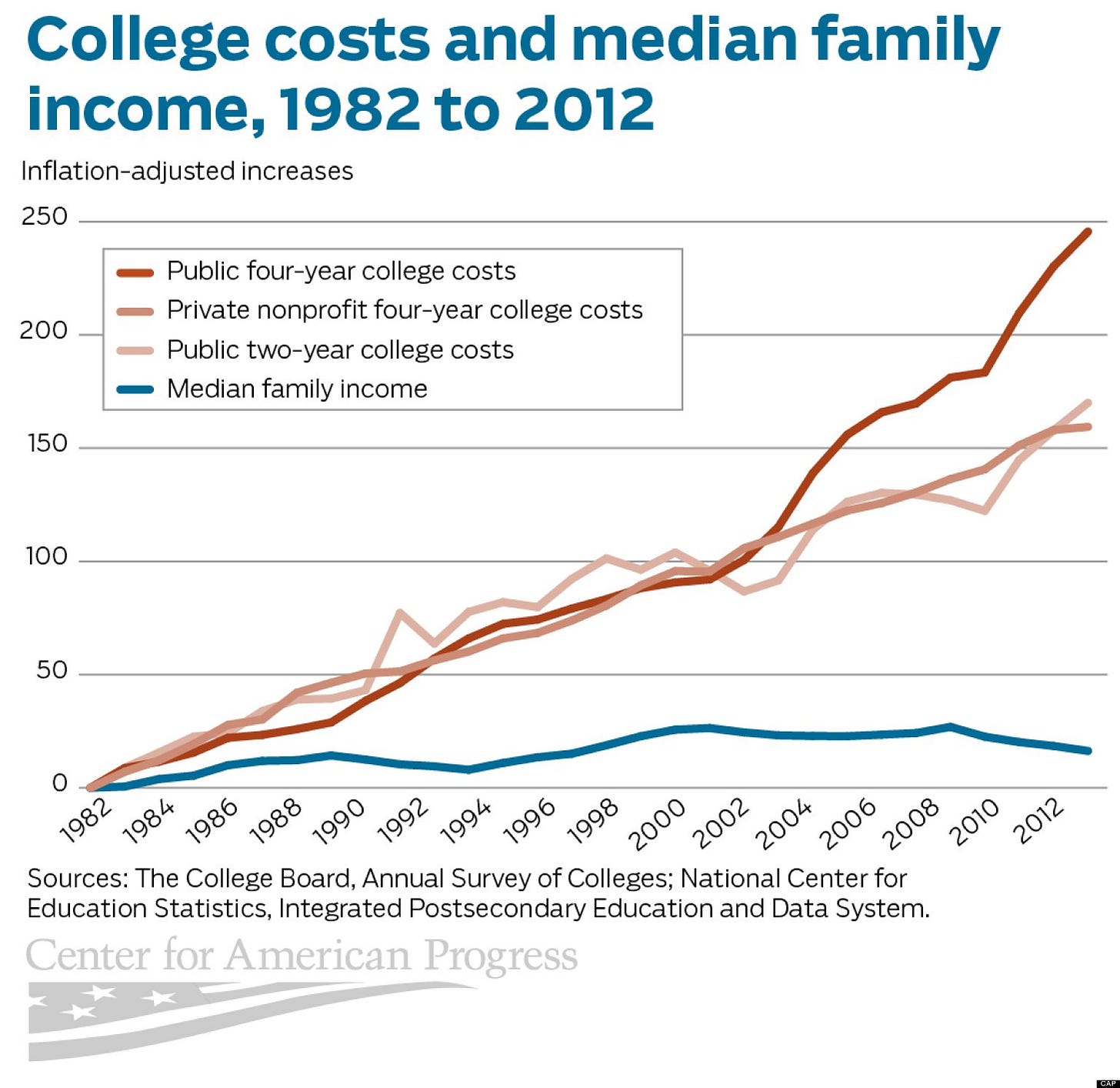

The real source of the problem is the increasingly exorbitant costs of education. If it wasn’t so ridiculously expensive, the whole problem (whatever the solution might be) would be much smaller in the first place.

(https://www.huffpost.com/entry/college-costs-median-income_n_3443806)

If something is really expensive and people can’t afford it, the main question you should be asking isn’t “How can we make someone else pay those costs?” The main question you should be asking is, “How can we reduce the costs?” Obviously, right? But politicians hardly ever think of that. I suppose it’s because they have a parasitic mindset, so to a politician, wealth doesn’t come from finding ways to be more productive or cut costs; wealth comes from taking stuff from other people.

Why is college so expensive? Partly because we’re constantly increasing administrative bloat. Also partly because we’re increasing the services we provide to students, e.g., providing lazy rivers and buffalo-shaped swimming pools to attract more students.

But why do we do these things? Why can we get away with it?

Mainly because students are price-insensitive – for some reason, they give little weight to costs when deciding where to go to college. As long as that’s the case, we’ll keep wasting money and jacking up our prices. The cost of education isn’t set by the laws of nature. The cost of education is set by university administrators, and there is no limit to how high they will make it, as long as there are people willing to pay.

Now, why are students price-insensitive? Perhaps partly because they are young and imprudent. But also because (a) they aren’t the ones paying – they expect their parents or the government to pay; (b) they expect to be able to put off paying for a long time, and they have high time preference.

So what will happen if the government pays off all student debt? Current and future students will become even more price-insensitive, anticipating the possibility of a similar deal for themselves in the future. So the core problem – the outrageous costs – will only increase.

That’s like most government programs: they make the problem that motivated them worse.

“ is the author of the above article just forgetting that when the government gives one person money, they take it from someone else?”

Well, to be more accurate, government borrows the money, for the most part. And they seem to think they will never have to pay that back, either. That still takes resources from ordinary persons, since there are only so many resources available at any particular moment. Just not always in the form of explicit taxes. This causes Inflation and other economic distortions.

“Maybe Democrats think this move is going to help them win in 2024. “

Or maybe they think that it helped them when Biden and many of the also-rans campaigned on it, and for once they want to fulfill a campaign promise. But that seems implausible. Politicians almost never keep campaign promises, even simple and easy ones that would not cause disaster like this one. Why the exception in this case?

Why is it popular with anyone? The people who will gain might support it, but if the political scientists (and our friend Bryan Caplan) are correct, it is empirically rare that voters vote their direct individual interest. But putting that aside, how would even a leftist think this was a good idea? I suppose they could frame it as a sort of insurance against buyer's remorse, or just plain compassion; but many of those whose debts will be forgiven do not regret their deal, and those among them that truly deserve compassion do so for reasons other than having made a bad decision when purchasing education. A program targeting persons in need would at least make sense. This is just nuts.

Private well developed credit markets are a blessing. Apart from allowing you to finance projects that make sense (or so it seems), when they do their homework provide you an independent assestment of the viability of your project. And they have significant skin in the game.

Private-non-subsidized student loans would be wonderful to reduce the price of grades with very little market value. It does not make any sense to pay north of $70,000 per year to complete a degree with entrance level median earnings of $30,000 (an antropology degree at Columbia, acording to the WSJ). If you try to get a loan from a private lender to finance this nonsense they will let you know.

The main problem wiht college is, precisely, that they don't have any skin in the game in your future. There is no mechanism linking the cost of your degree and your future earnings.

If private markets can provide that. Why not let them doing so?